Wells Fargo 587343 2013-2026 free printable template

Show details

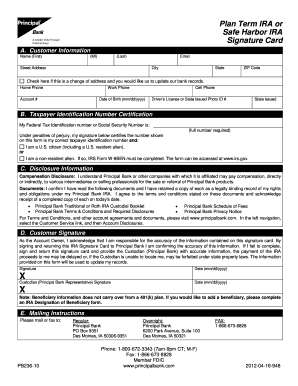

Section IV Gross-up Election You may be eligible to gross-up your hardship amount up to 30. The IRS allows you to include in the reasonably anticipated as a result of this withdrawal. If no election is made your election to gross-up will be waived. Please select one of the following options Gross-up my approved amount by 30. maximum allowed is 30. I elect to waive my option to gross-up. Section V Tax Withholding Note Tax withholding elections cannot be changed after the withdrawal is...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wells fargo 401k withdrawal form

Edit your form hardship withdrawal request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hardship letter for 401k withdrawal example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hardship withdrawal form pdf online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit wells fargo ira withdrawal form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Wells Fargo 587343 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wells fargo hardship request form

How to fill out Wells Fargo 587343

01

Begin by obtaining the Wells Fargo 587343 form from the Wells Fargo website or a branch.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information in the designated fields, including your name, address, and account number.

04

Provide any necessary financial details requested on the form.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form if required.

07

Submit the form either online through the Wells Fargo portal or in-person at a branch.

Who needs Wells Fargo 587343?

01

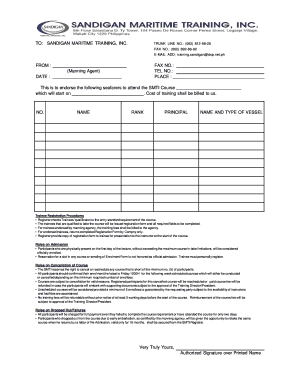

Individuals or businesses that have accounts or transactions with Wells Fargo may need to fill out form 587343.

02

Clients seeking specific banking services that require formal documentation.

03

Customers who need to provide certain information for regulatory or compliance purposes.

Fill

401k hardship withdrawal letter

: Try Risk Free

People Also Ask about 401k hardship withdrawal letter template

How do I get my 401k hardship withdrawal approved?

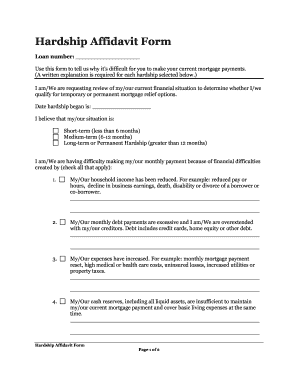

To be eligible for a hardship withdrawal, you must have an immediate and heavy financial need that cannot be fulfilled by any other reasonably available assets. This includes other liquid investments, savings, and other distributions you are eligible to take from your 401(k) plan.

What are the IRS regulations regarding hardship withdrawals?

The amount of a hardship distribution must be limited to the amount necessary to satisfy the need. This rule is satisfied if: The distribution is limited to the amount needed to cover the immediate and heavy financial need, and. The employee couldn't reasonably obtain the funds from another source.

Does IRS require proof of hardship withdrawal?

You do not have to prove hardship to take a withdrawal from your 401(k). That is, you are not required to provide your employer with documentation attesting to your hardship.

How do I fill out a hardship withdrawal form?

Request Form Complete all relevant sections after reading all the information in the package. Indicate the reason for your hardship request on the form. You must also provide the appropriate documentation evidencing financial need. Sign and date the form.

How do I prove hardship for IRA withdrawals?

You can also take a penalty-free hardship withdrawal if you've experienced “total and permanent disability.” One of the easiest ways you can prove this and avoid the early withdrawal penalty is by taking disability payments from an insurance company or through Social Security.

What qualifies for a hardship withdrawal?

A hardship distribution is a withdrawal from a participant's elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrower's account.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 401k terms of withdrawal example directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your wells hardship withdrawal and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an eSignature for the terms of withdrawal in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 401k hardship withdrawal letter sample and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out example of hardship letter for 401k withdrawal using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign wells fargo power of attorney form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is Wells Fargo 587343?

Wells Fargo 587343 refers to a specific form or document used by Wells Fargo for certain banking or financial transactions.

Who is required to file Wells Fargo 587343?

Individuals or entities that engage in transactions that meet specific criteria set by Wells Fargo are required to file this form.

How to fill out Wells Fargo 587343?

To fill out Wells Fargo 587343, follow the instructions provided on the form, ensuring that all required information is accurately entered.

What is the purpose of Wells Fargo 587343?

The purpose of Wells Fargo 587343 is to collect necessary information for compliance and reporting requirements within the financial institution.

What information must be reported on Wells Fargo 587343?

The form typically requires reporting personal identification details, transaction specifics, and any other information necessary for regulatory compliance.

Fill out your Wells Fargo 587343 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Hardship Withdrawal Form is not the form you're looking for?Search for another form here.

Keywords relevant to wells fargo 401k withdrawal online

Related to how to write a letter for a 401k hardship withdrawal

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.